Swan Financial Services at 50

1974-2024

Don Swan was 41 and had been working in charities and as a book-keeper for most of his working life. Most recently he had been working as a representative of a Swedish timber company, called Oulux (now marketed as SupaLux.) This involved commuting across the country every week in a company car, selling this product to Builders’ Merchants and housebuilders. However, it was after a major car accident on the M1 that he decided he wanted to work without that level of commuting, driving and danger. (The car ended up on its roof!)

So, he followed up on an approach from a recruiter and in 1974 Don began offering financial advice from Trafalgar Road in Greenwich. This was a small space in the offices of his brother’s building company.

Originally this was with Albany Life. This was how all advisers were recruited in the 1970s as representatives of one main company, and as was normal, Don also had some contracts with a few other companies. This was called ‘Multi Tie’, that is, not to be tied to representing one single company, but having associations with two or three. He had a natural talent for the job, with his salesmanship, shrewd book-keeping experience, and infamously charming personality. He soon built a thriving practice and found he was too busy to work alone – he needed administrative support. He moved to the Albany Life offices, which were in Surrey at that time, and quickly built on his success - he had found his talent.

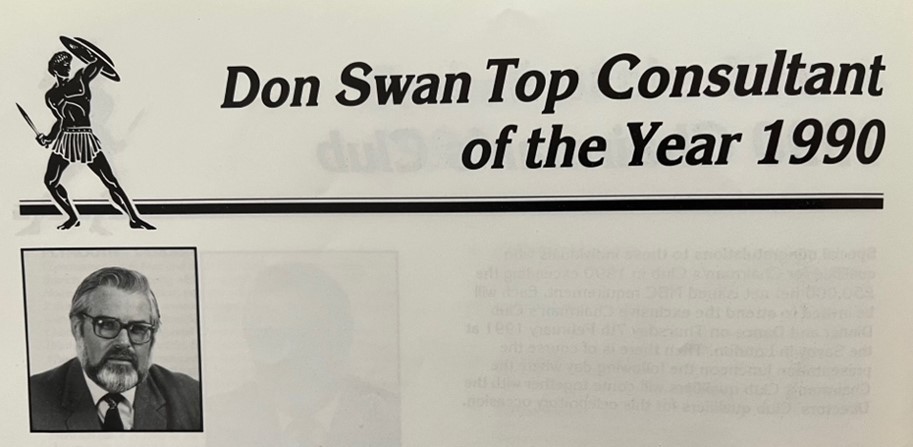

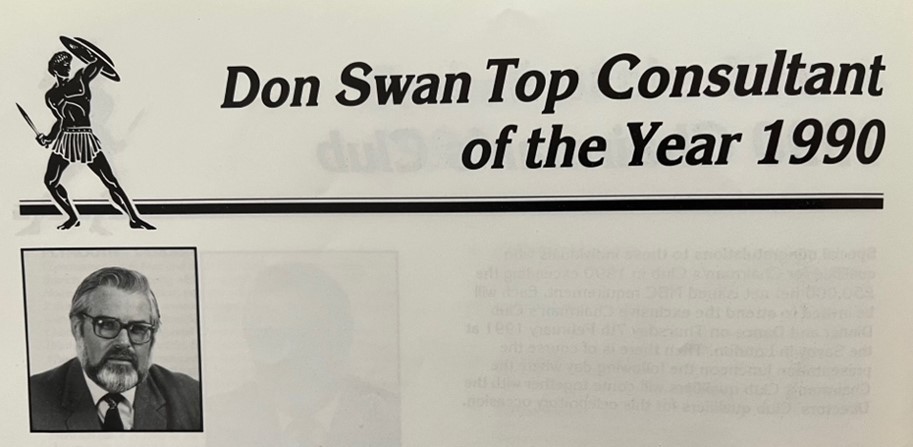

He was soon a regular at the various award ceremonies for Albany Life, becoming a member of the Life Insurance Association, finally receiving the Fellowship of that organisation, and was recognised as a stalwart of what we now know as Financial Planning. He was not just a salesman; he developed and maintained relationships with many clients which went beyond the normal type of contact and advice typical of the 1970s and 80s. The industry normally used ‘sell and move on’ practices, but he recognised that there was a better way. He was constantly returning to his clients, developing enduring relationships which ensured that he was always meeting their needs and helping them to achieve their long-term goals. He built a very successful business with Albany Life and his energetic approach was equally evident in his private life. He was well-known beyond the office for his prolific work on the local council, sitting on the board of many schools’ governing bodies as well as on some London-wide bodies at County Hall. He was even Mayor of Greenwich for a year. His business life and public life were built on the same care and concern for all.

However, the financial world was changing. There was a major change in the late 1980s and early 1990s where the distinction of advisers changed to be either agents of a company, like Don, or Independent Financial Advisers, (IFAs), who acted as agents of the clients. Although Don was now a well-respected and experienced agent of Albany Life, the plans he put in place and the advice he gave were now restricted to using solutions from one company alone, Albany Life.

I originally joined the financial industry in 1983, and had gained extensive experience in a variety of major banks in various roles, but principally as an Independent Financial Adviser for the customers of those banks. The experience of working in bank branches, both on counter operations and as a fully qualified IFA, was invaluable with all the changes that were happening in the financial world.

This led to me joining my father in 1996 with the express aim of taking the business, as the lead adviser, and transferring it to a full IFA practice. This plan incorporated Don’s extensive experience and client bank with my (relative) youth and experience, along with all the benefits of independent advice.

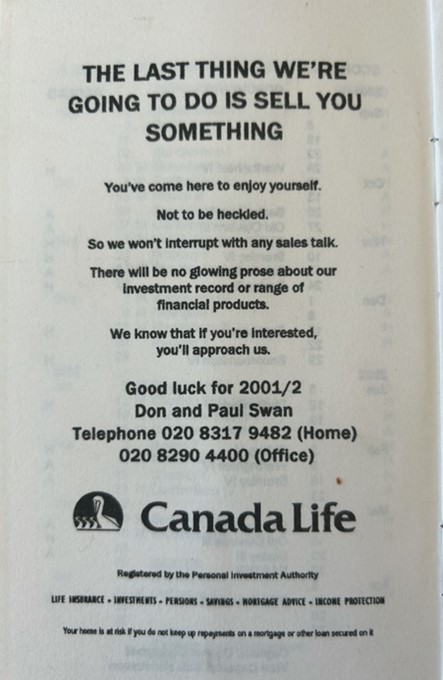

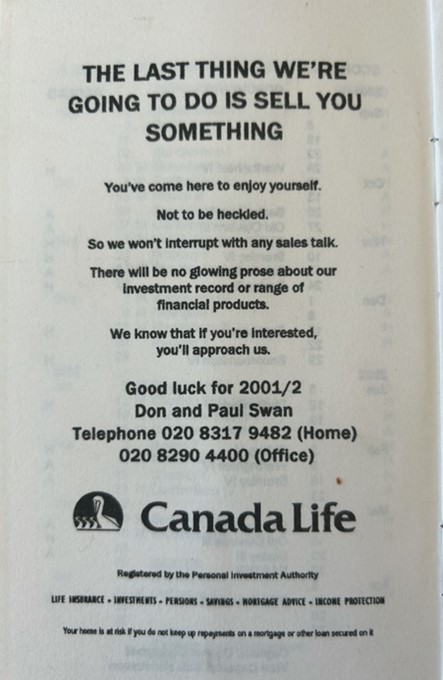

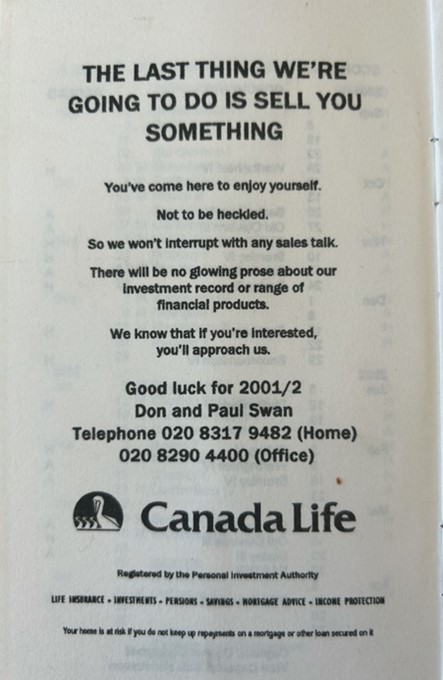

A series of external events then occurred, in quick succession, with Albany Life being bought by Canada Life, and them then selling the entire sales force to a large national IFA group called Berkley Woodhouse Associates. All the changes culminated in Swan Financial Services joining Positive Solutions in March 2004 as Partner Independent Financial Advisers.

Initially we had offices in Greenwich Market, (the Ministry of Defence was our landlord for a time!), and those offices were a great location and great space. We loved being in the heart of our hometown, not to mention the fabulous pie and mash at lunch time! Sadly, our time there was cut short by Don’s cancer diagnosis in 2005 which significantly restricted his ability to work at the same pace as he had done for many years. We had to make some radical changes and shrunk the office space to better suit the new situation.

Having continued his work for Swan Financial Services all the way until late 2008, Don passed away in 2009, leaving a great legacy in both the financial advice industry and the Greenwich community.

By now I was working close to my home in Tonbridge and continued to trade and practice as a Sole Trading IFA. The support of the Positive Solutions back office and the many advances in modern technology have all made it possible for me to continue working this way without having to merge with a larger firm.

Over the last 15 years, I have seen Swan Financial Services through many more changes and developments. Positive Solutions separated into two arms, the original partner-based IFA network and a new company, called True Potential, which was based on a new version of the technology and taking a similar approach to the original Multi-Tie model that Don started with at Albany Life. (We now call that a Restricted Advice Model with a selection of products and funds from a range of companies, and it is fast becoming the norm again).

Positive Solutions was bought by a larger group called Intrinsic, who allowed me to remain as a Sole Trading IFA. Subsequently, Intrinsic combined their business with the UK arm of Old Mutual Wealth, a South African based company. This was renamed Quilter and is now a UK FTSE 250 company with many parts, which includes Positive Solutions.

Through all these complicated changes, for me, and you, at the heart of our company, there is a commitment to maintain Independent Financial Advice and the ability of IFAs to practice as such. I now have a range of support and associates that allow me to still offer the full range of financial services: mortgages of all sorts, Equity Release and Long-Term Care funding, Pensions of all sorts, Protection, and Investment.

I am still committed to developing the technology that I use here to ensure that I maintain my independence and continue to keep to my aim of

“Providing trusted and personal advice, enabling our clients and their families to feel comfortable and secure in their financial planning over the longer term.”

This commitment to independence has allowed me to advise and guide as I have done over the last 30 years, and as we have done as a firm for 50 years, giving advice with no edge, not looking for any personal advantage or gain, but instead giving trusted and personal bespoke advice. It is based on a belief that everyone deserves the best that I can offer as a Financial Adviser, no matter what their stage of life or wealth. I am part of a group of advisers who think that before you give Financial Advice, you need to understand the life that people have and aspire to, the tools and assets that they have to get there and then, only then, apply the appropriate advice. That is the way Don started 50 years ago and how I will continue to support you into the future.

Happy Birthday Swan Financial Services!

Swan Financial Services at 50

1974-2024

Don Swan was 41 and had been working in charities and as a book-keeper for most of his working life. Most recently he had been working as a representative of a Swedish timber company, called Oulux (now marketed as SupaLux.) This involved commuting across the country every week in a company car, selling this product to Builders’ Merchants and housebuilders. However, it was after a major car accident on the M1 that he decided he wanted to work without that level of commuting, driving and danger. (The car ended up on its roof!)

So, he followed up on an approach from a recruiter and in 1974 Don began offering financial advice from Trafalgar Road in Greenwich. This was a small space in the offices of his brother’s building company.

Originally this was with Albany Life. This was how all advisers were recruited in the 1970s as representatives of one main company, and as was normal, Don also had some contracts with a few other companies. This was called ‘Multi Tie’, that is, not to be tied to representing one single company, but having associations with two or three. He had a natural talent for the job, with his salesmanship, shrewd book-keeping experience, and infamously charming personality. He soon built a thriving practice and found he was too busy to work alone – he needed administrative support. He moved to the Albany Life offices, which were in Surrey at that time, and quickly built on his success - he had found his talent.

He was soon a regular at the various award ceremonies for Albany Life, becoming a member of the Life Insurance Association, finally receiving the Fellowship of that organisation, and was recognised as a stalwart of what we now know as Financial Planning. He was not just a salesman; he developed and maintained relationships with many clients which went beyond the normal type of contact and advice typical of the 1970s and 80s. The industry normally used ‘sell and move on’ practices, but he recognised that there was a better way. He was constantly returning to his clients, developing enduring relationships which ensured that he was always meeting their needs and helping them to achieve their long-term goals. He built a very successful business with Albany Life and his energetic approach was equally evident in his private life. He was well-known beyond the office for his prolific work on the local council, sitting on the board of many schools’ governing bodies as well as on some London-wide bodies at County Hall. He was even Mayor of Greenwich for a year. His business life and public life were built on the same care and concern for all.

However, the financial world was changing. There was a major change in the late 1980s and early 1990s where the distinction of advisers changed to be either agents of a company, like Don, or Independent Financial Advisers, (IFAs), who acted as agents of the clients. Although Don was now a well-respected and experienced agent of Albany Life, the plans he put in place and the advice he gave were now restricted to using solutions from one company alone, Albany Life.

I originally joined the financial industry in 1983, and had gained extensive experience in a variety of major banks in various roles, but principally as an Independent Financial Adviser for the customers of those banks. The experience of working in bank branches, both on counter operations and as a fully qualified IFA, was invaluable with all the changes that were happening in the financial world.

This led to me joining my father in 1996 with the express aim of taking the business, as the lead adviser, and transferring it to a full IFA practice. This plan incorporated Don’s extensive experience and client bank with my (relative) youth and experience, along with all the benefits of independent advice.

A series of external events then occurred, in quick succession, with Albany Life being bought by Canada Life, and them then selling the entire sales force to a large national IFA group called Berkley Woodhouse Associates. All the changes culminated in Swan Financial Services joining Positive Solutions in March 2004 as Partner Independent Financial Advisers.

Initially we had offices in Greenwich Market, (the Ministry of Defence was our landlord for a time!), and those offices were a great location and great space. We loved being in the heart of our hometown, not to mention the fabulous pie and mash at lunch time! Sadly, our time there was cut short by Don’s cancer diagnosis in 2005 which significantly restricted his ability to work at the same pace as he had done for many years. We had to make some radical changes and shrunk the office space to better suit the new situation.

Having continued his work for Swan Financial Services all the way until late 2008, Don passed away in 2009, leaving a great legacy in both the financial advice industry and the Greenwich community.

By now I was working close to my home in Tonbridge and continued to trade and practice as a Sole Trading IFA. The support of the Positive Solutions back office and the many advances in modern technology have all made it possible for me to continue working this way without having to merge with a larger firm.

Over the last 15 years, I have seen Swan Financial Services through many more changes and developments. Positive Solutions separated into two arms, the original partner-based IFA network and a new company, called True Potential, which was based on a new version of the technology and taking a similar approach to the original Multi-Tie model that Don started with at Albany Life. (We now call that a Restricted Advice Model with a selection of products and funds from a range of companies, and it is fast becoming the norm again).

Positive Solutions was bought by a larger group called Intrinsic, who allowed me to remain as a Sole Trading IFA. Subsequently, Intrinsic combined their business with the UK arm of Old Mutual Wealth, a South African based company. This was renamed Quilter and is now a UK FTSE 250 company with many parts, which includes Positive Solutions.

Through all these complicated changes, for me, and you, at the heart of our company, there is a commitment to maintain Independent Financial Advice and the ability of IFAs to practice as such. I now have a range of support and associates that allow me to still offer the full range of financial services: mortgages of all sorts, Equity Release and Long-Term Care funding, Pensions of all sorts, Protection, and Investment.

I am still committed to developing the technology that I use here to ensure that I maintain my independence and continue to keep to my aim of

“Providing trusted and personal advice, enabling our clients and their families to feel comfortable and secure in their financial planning over the longer term.”

This commitment to independence has allowed me to advise and guide as I have done over the last 30 years, and as we have done as a firm for 50 years, giving advice with no edge, not looking for any personal advantage or gain, but instead giving trusted and personal bespoke advice. It is based on a belief that everyone deserves the best that I can offer as a Financial Adviser, no matter what their stage of life or wealth. I am part of a group of advisers who think that before you give Financial Advice, you need to understand the life that people have and aspire to, the tools and assets that they have to get there and then, only then, apply the appropriate advice. That is the way Don started 50 years ago and how I will continue to support you into the future.

Happy Birthday Swan Financial Services!

Read less